SWOT is a management analysis tool. It is used to get an overview of the situation. This overview can help us diagnose managerial problems or they can help in planning. We will discuss SWOT analysis with example to illustrate how to use it effectively.

Contents

What is SWOT analysis?

SWOT is a planning tool. The word is made of four words Strength, Weakness, Opportunities and Threats. Let us discuss each of these words and their significance in detail:

| Internal/External | Components of SWOT | Meaning |

|---|---|---|

| Internal | Strength | The areas where you have an advantage over others |

| Internal | Weakness | The areas where you have a disadvantage over others |

| External | Opportunities | An untapped prospect that can help you if it is utilized |

| External | Threats | An impending prospect that can harm you if it occurs |

We shall discuss all of these four elements of SWOT analysis in detail. However, let us first check out why we need it in the first place. We should also be very clear about the need for conducting this analysis. Then, we shall proceed to SWOT analysis with example.

Specific examples of using SWOT

- Starting a new business: SWOT analysis can help you ascertain whether it makes sense to go ahead with the business or not.

- Feasibility analysis of a project: A feasibility analysis is done before starting a new project. SWOT can help us determine whether it makes sense to pursue an idea or drop it.

- Assessing corporate stand: Sometimes, we may not have a clear picture of where we stand. SWOT can help us get a snapshot of our situation. This can help in strategic planning.

- Personal planning: SWOT is not limited to corporate usage. You can use it to get a better understanding of your personal assessment. It can help you explain better at job interviews. Also, it can help you with personal development.

- Brainstorming: SWOT can be a useful tool to analyze brainstorming ideas. It can help in benchmarking ideas. There are 3 types of brainstorming and SWOT can be used with all three.

SWOT Analysis with Example

Example: a multinational bank

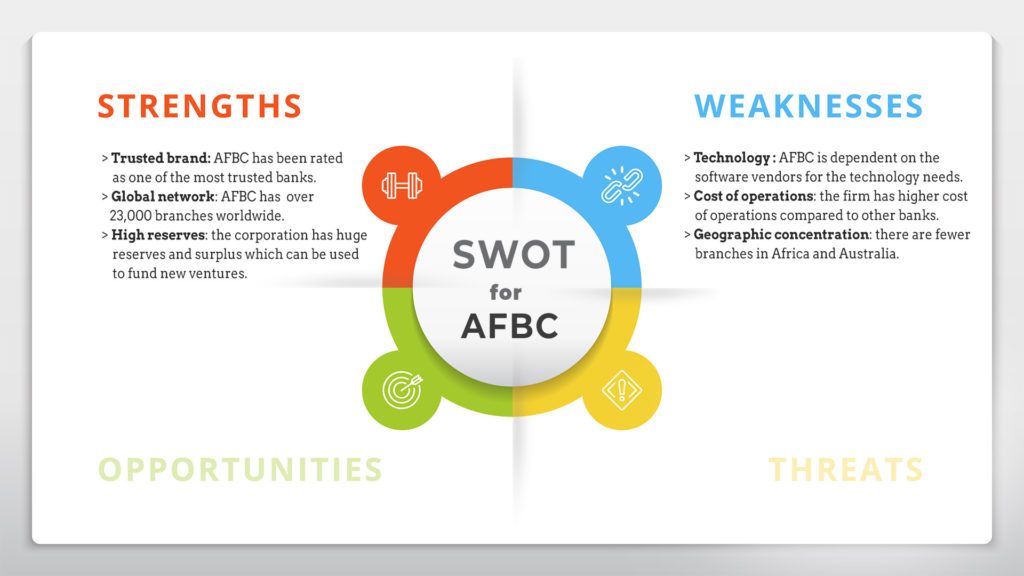

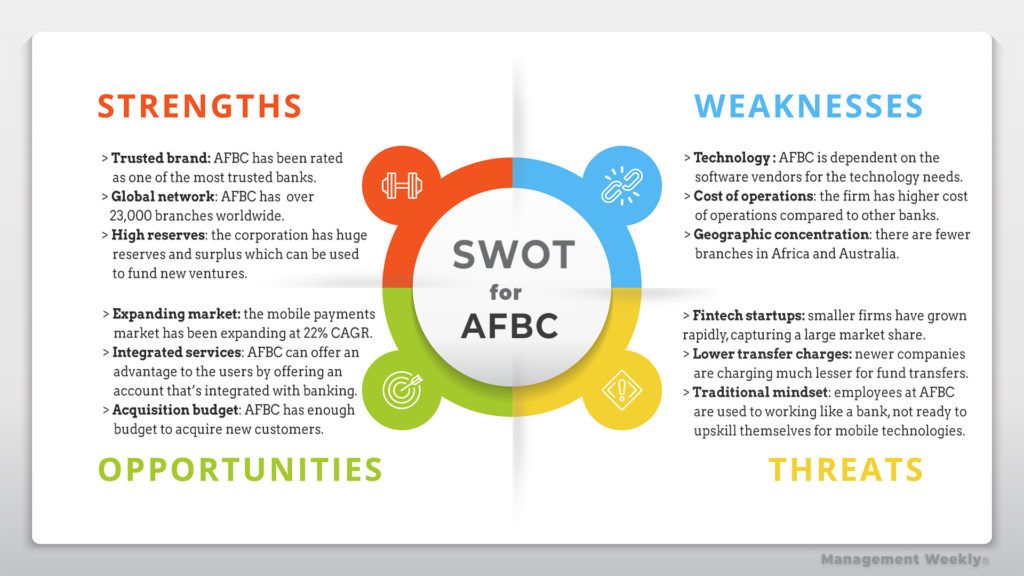

Consider a multinational bank, Abracadabra Finance & Banking Corporation, or AFBC. The bank has a presence in 105 countries with over 23,000 branches worldwide. It wants to enter the mobile payments market. You are hired as a consultant to conduct the feasibility analysis of the project. You decide to start with SWOT analysis. How should you go about it?

Step 1: Evaluation of Internal Factors: Strengths and Weaknesses

The strengths and weaknesses are internal factors. It means that you find out about your strengths and weaknesses Always remember that these are relative assessments. Assess your strength with respect to your rivals.

What are strengths and weaknesses?

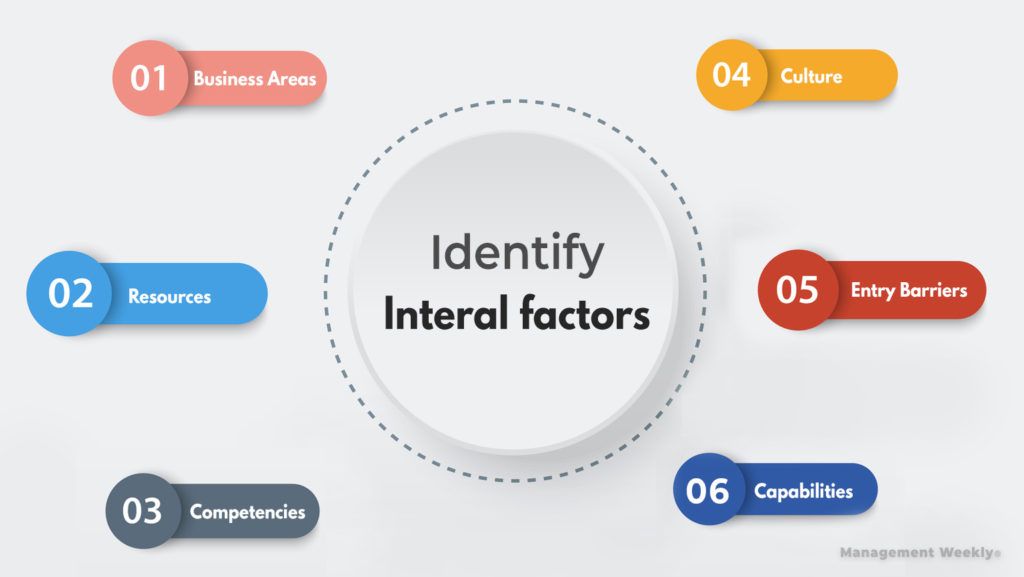

The strengths and weaknesses for your firm are identified by some common criteria:

- They are external with respect to the firm( not part of organizational resources, competencies and functional areas)

- These factors are uncontrollable

- They usually occur in the environment ( natural, geo-political, etc)

- They can also come from rivals

- Enhance or deplete a firm’s performance

How to identify your strengths?

- Think about the different functional areas of your firm/project. What areas have better resources? It can be either measured independently or with respect to your competitors.

- What are the core competencies? Is there something you are strong at? These should be enlisted in the strengths.

- Think like Prof Porter: what are the barriers to entry that you can put up against a new entrant? A patent or trademark or even a trade agreement can be your strength.

How to identify your sweaknesses?

- What are the areas where you are not as strong as your competitors? It could be competency, resource, or capability.

- It is not just about having ownership but also access to resources. For example, both you and your rival have similar suppliers. However, you can get a specific part made 25% slower then it will become your weakness.

- Most importantly, culture is a type of hidden attribute. Usually, people neglect culture when thinking about a firm. This can be a mistake. In fact, in post mergers and acquisitions, culture is seen as a major weakness. Therefore when you are doing a SWOT for acquisition, never miss assessing the cultural synergy between both organizations.

Analysis of internal forces for our SWOT example:

Step 2: Develop the Transition Strategy

Once you have the list of your strengths and weaknesses, you can develop a strategy to work on them.

- Nurture your strengths.

- Develop competencies, resources, and capital.

- Acquire the resources to eliminate weaknesses. For instance, AFBC bank may acquire some software provider or build an in-house team to remove the dependency on external software vendors.

- Brainstorm with the executives to find potential solutions to the weaknesses. Develop strategies to eliminate the weaknesses based on these solutions.

Step 3: Evaluation of External Factors: Opportunities and Threats

There is a reason why we have kept the external factors as the second step. One of the most powerful theories in management is Prospect Theory. Daniel Kahneman got the Nobel prize for developing this theory along with Amos Tversky. This theory says that we are more affected by loss than by gain. This stems from human nature to focus on the risks rather than the potential gains. When we talk about management strategy, similar rules apply. People have an inherent bias towards analyzing the risks or threats. However, we need to look at the “negative risks” or opportunities with a similar zeal.

How to ascertain threats and opportunities?

- Technological trends: this one is extremely important. Firms have closed down because of not picking up on tech trends. Also, startups have become unicorns by picking up on a tech trend.

- Market forces: the markets are highly dynamic. Always. Watch out for the market forces when doing your external analysis for SWOT.

- Competitor’s arsenal: A thorough analysis of your competitor can give you some of their secrets. Sometimes, there may be just one of two factors that contribute majorly to their success. List them as your unmet opportunities. Try to find a gap in the approach of your rivals.

- New entrants: new entrants in the market are hungry for growth. Any firm in your domain with a high Year-on-Year growth rate can point towards a potential threat. You can use any metric like sales, market share, revenues, PAT, or ROCE to assess the new entrants. A deep dive into their value chain will tell you how they can become threats to your business some time down the line.

- Consumer patterns: consumption patterns change over time. This can be both a threat as well as an opportunity. It depends on how you prepare for them.

We are doing SWOT Analysis with example of our company, AFBC. Let us see how our SWOT chart looks like:

Step 4: Turning Threats into Opportunities

The final step is to develop strategies to convert threats into opportunities. It is easier said than done. However, there are some approaches.

- Threats are highly beneficial sources of organizational change. It is like the creative destruction of old into a new firm.

- Look at the threats from a new lens. Observe how the competitors reacted to the threats. Also, look at firms that have complementary strengths. How are they doing things differently?

- Think out of the box, be creative in findings potential solutions. Again you can build a team for managing this transformation project. Use the power of the team for brainstorming in project management.

- Think of small changes that eliminate threats in the long run rather than radical ones. Embrace the concept of Kaizen.

FAQs on SWOT Analysis

SWOT means Strength, Weakness, Opportunities, and Threat analysis. It is a framework to get an overview of the firm’s situation.

The SWOT analysis contains both internal as well as external aspects. On one hand, the Strengths and Weaknesses are internal to the firm. On the other hand, Opportunities and Threats are external to the firm.

No, SWOT analysis is not a theory. It is only a pontification tool. It means that this tool helps us ‘list’ some points under each heading S, W, O and T. On the other hand, theories are used to explain and predict a phenomenon. SWOT cannot be used for explanation or prediction.

We can use SWOT analysis for the assessment of a product, idea, project, person, or company. It helps us in planning for and reducing the impact of risks and internal shortcomings. On the other hand, it also helps us in increasing the benefits of opportunities and internal competencies.

Yes, SWOT analysis is an effective tool. It is a simple preliminary tool and good to get an overview. However, it is more effective when we deep dive into each of the points under the strengths, weaknesses, opportunities, and threats.

SWOT works by helping us list down certain key aspects of a firm. We make points under each of the four headings. These points help us identify our strengths and weaknesses. We can work towards improving them. SWOT analysis with an example like we have discussed also helps us to find out risks and opportunities outside our firm.

SWOT analysis can be performed before the launch of a new product or starting a firm. It can also be used to evaluate and improve the firm.

Risk assessment is not the same as SWOT. It is a more detailed and systematic process. It involves an assessment of potential hazards, accidents, and risky-events. This term is usually used in specialized contexts like financial risk or manufacturing risk, etc. On the other hand, SWOT is a simple analysis tool for quickly getting an overview of a project or firm.

SWOT and PEST analysis is very different. SWOT is mainly to assess the firm’s situation with respect to risks and opportunities. PEST is a tool to assess the external forces like geo-political, social, economic, and regulatory.

> A simple and fast process

> An easy process

> It can help us identify some blindspots

> Gives an overview

6 thoughts on “SWOT Analysis with Example”