There are various schools of thought in economics and neoclassical economics is one of the major ones. Schools of thought are a broad classification of ideology that come under a similar set of assumptions, notions, and methodology. Neoclassical Economists believe that individual decision making can be modeled on their need to maximize their personal utility.

What is Neoclassical Economics?

Neoclassical economics has its roots in the “neoclassical” era which spanned between 1870 and 1933. There is no cutoff date. However, strong consensus puts the neoclassical era origins somewhere around the early 1900s. In the NE school, mathematical inquiry became a mainstream methodology.

Neoclassical economics definition

NE is an umbrella term for a set of theories that have a common set of underlying explanatory predictors and outcomes; mostly using supply and demand to predict the production and consumption patterns. It was preceded by classical economics. Thorstein Veblen coined the term NE and he was quite critical of the concept. We shall discuss this, subsequently, later in this article.

Neoclassical economics theory

At its core, NE has two essential principles: methodological individualism & rational choice(Boland, 1998). The first philosophy posits that economics can be looked as sets of choices made by individuals. The second philosophy is that of ‘rational choice’. These two principles have been the foundations of many of the modern economic theories.

The NE model

One of the most common models in NE builds upon the utility maximization principle. Under the assumption of a competitive and free market, it can be used to determine the price for a commodity.

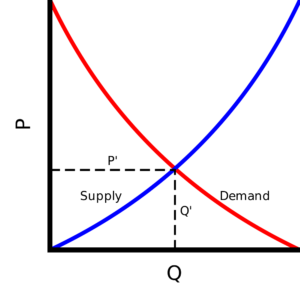

Let us consider a product, say a bar of soap. Let us say that there are 1000 people who would buy(demand for the soap is 1000 pieces) it at the market price of $10. As the price of soap decreases, to $9 more people should buy it. Thereby, the demand shoots up to 1200 pieces. This nature of demand is called elasticity which means that it changes with respect to price. It is evident from the graph below. The red color line shows the ‘demand function’ or graph for demand.

Likewise, for the same soap, let us say there are 5 producers who are ready to sell the product at $10. As a result of a price drops to $9, some of the producers will not be willing to sell it because it would either cause them a loss(if the cost of producing the soap) or they are not ready to sell it lower price point. For instance, there may be only 4 producers of soap at $9. This is called the elasticity of supply. In the graph below you can see the blue line which represents the supply. As the price of the product increase, there are more and more sellers ready to sell it.

Consequently, this means is that if there is a demand for some good, then it must be balanced by the supply. There will be a point where the supply and demand requirements meet. This common point is called equilibrium and it dictates the market economics.

This is the most basic represenation of the supply-demand equilibrium model. You can refer to textbooks in economics for more advanced discussion of topics

Example of NE

The artificial price of natural diamond

One of the classical(no pun intended) and controversial(no uproar in comment section intended) of NE is the diamond industry. Diamonds are plentiful in nature and quite cheap to mass-produce. Therefore, they have very low intrinsic value, however, they are sold for a premium price. The basic business model of De Beers, a monopolistic company that operates most of the diamond industry is based on the NE model. It has an elaborate set of measures to ensure control over the ‘supply’ side of the market. They ensure that there are as few as possible diamonds released to the markets which makes the prices sky-rocket.

In addition to that, the company is also known for one of the most inflationary campaigns in American consumer history. It created a campaign in the form of radio and print ads where it proclaimed that any man who loves a woman should spend two months of his salary in a diamond ring for her.

In conclusion, government controls are needed for the regulation of such practices. Regulatory measures can lead to the curbing of rampant looting of innocent consumers. Decartelization and lawsuits helped reduce the market share of De Beers from about 90% in 1987 to about 37% in 2018.

Assumptions of NE

One of the differences is that while classical economists looked at economics from a producer’s perspective while the NE looks at economics from the consumer’s perspective. As a result, the first assumption of NE is that utility rather than ‘cost of production’ drives the market prices of goods and services. Consequently, the value of produce is not only governed by the cost of production but may have a premium beyond the cost of production due to the perceived utility a consumer derives from it. This leads to an implicit assumption that the key purpose of a firm is to maximize profits.

Moreover, the second common but sometimes implicit assumption is that of the ‘rational behavior’ of an individual. NE theories posit that the primary concern of an individual is to maximize their personal satisfaction from any action. Thereby, they try to act selfishly in their own interest. This means that for every resource they have, they would like to make a decision that results in the highest satisfaction for them.

Classical vs Neoclassical

This debate is based on the premise of the economic model. Firstly, as the name suggests, Classical Economics(CE) came before Neoclassical economics. However, there is no cut-off date delineating them. It is merely a school of thought or idealogy and both form the part of mainstream economics today. One of the simplest comparisons of the same is provided below:

| Classical Economics | Neoclassical Economics | |

|---|---|---|

| Focus of analysis | Production of goods and services | Individual acts of self interest |

| Assumption | Price = function(labour cost, material cost) | Price = function(value); Rational choice |

| Factors for equilibrium | Cost of Production & Retail Price | Demand and Supply |

| Key scholars | Adam Smith, Jean Batiste Say, David Ricardo | Carl Menger, Eugen von Böhm-Bawerk, Leon Walrus |

| Key critics | Marx, Veblen | Veblen, Keynes, Marx |

Neoclassical economics and Behavioral Economics

We have discussed that one of the assumptions of NE is rationality. Behavioral economics breaks that assumption. Behavioral economics(BE) is based on a set of theories that model human behavior. One of the keystone theory is the tendency of individuals for ‘loss aversion’, published in the seminal paper of Kahneman and Tversky in 1979. This theory states that people are more loss-averse than they are gain seeking: a loss of $1000 hurts more than a gain of $1000!

BE models the actual behavioral responses to situations where individuals act in a manner that at times may contradict the strictest ‘economic sense.’ This also breaks the second assumption of ‘utility maximization,’ where individuals may but an overly expensive iPhone over a Samsung Galaxy that offers imperceptibly similar performance at half or lower the price(a subjective statement to give an example).

In fact, Nobel laureate economist Richard Thaler also claims that the irrational individual would be ‘dumber and nicer’ than what neoclassical economists would believe. On the other hand, Paul Ormerod has said that modern economists must have some understanding of behavioral economics too, irrespective of their school of thought.

Criticism

Economics enjoys its own share of fandom as well as criticism. Some of the common complaints against economics, in general, are that it has deeply rooted assumptions, unrealistic focus on the prediction of the models and more importantly, failure of models altogether.

The first criticism stems from the assumption that the consumers are rational decision-makers. Contemporary economists converge towards a more realistic situation where the behavioral aspects of the decision making are also considered. Humans are prone to mistakes, emotional swings, irrational beliefs, and random fluctuations also. The dissent against mainstream economics which also includes NE is that over a period of time, the models became detached from reality and convoluted in mathematical equations that are highly speculative in nature.

Finally, there is also growing descent against the classical and neoclassical economists. The public perception of economists resembles these types of economists who focus on economic growth and wealth creation. If a firm follows the neoclassical model, then it can theoretically derive as much value from the consumer as much as they possibly can. This is especially true in ‘branded’ commodities like Starbucks Coffee or Fuji drinking water which is sold as massive margins just because people would pay for it. This is part of the capitalist culture which is looked down upon by some of the critics. Their rational is that neoclassical economics is focused on the transactional aspects of the production while neglecting the labor. A more nuanced development in the economic model should ideally include the human aspects as well.

Veblen was also critical of the fact that neoclassical economics stressed on profit maximization. According to him, this makes NE not any different from the CE.

Contemporary thoughts

The change in attitude towards the orthodox or neoclassical economics has lead to the creation of new streams of study. One of the prominent aspects of NE being questioned are:

- Rational individuals

- Rational firms

- Invisible hands

- Profit maximization

- Maximizing shareholder’s wealth

The heterodox economists are ones who are more critical of the NE. They have lesser trust in the aspects of NE like giving free hand to the firms without government intervention or belief in rational individuals who take perfect decisions. In “The changing face of economics, ” the authors state that the tenets of NE has always been the “holy trinity of rationality, greed, and equilibrium” and is being replaced by the trinity of “purposeful behavior, enlightened self-interest, and sustainability.” These changes present a refreshing look at how we envision our organizations, how we design public policies and how we ensure that the scarce natural resources are not depleted in a generation or two.