What is Autonomous Consumption?

Autonomous consumption definition

The consumption that is independent of the level of income is called autonomous consumption(AC). It is also known as exogenous consumption. Apart from the bare necessity for survival, it may also include payments towards loans and other obligations.

The counter to this type of consumption is induced consumption(IC) which signifies an expense that is dependent on the earning.

Moreover, there is another interesting term associated with AC: dissaving. In the condition that a person earning a salary per month. The person ideally spends money less than earning. The difference is accumulated as ‘savings’. The opposite of saving is called ‘dissaving’

In other words, dissaving is tapping into external sources of money when income is less than expenses. Generally dissaving is done by tapping into savings. However, in extreme cases, people arrange for money by selling off assets, goods, etc or by borrowing money, food, or services from others.

Autonomous Spending

Autonomous spending is a concept of macroeconomics. It is essentially automatic spending that is the bare minimum for a living person to exist. The expenses that are related to survival like food and shelter come under this category. An unemployed person needs these basic items to stay alive and would have it no matter how badly the economy functions.

On a larger level, the term autonomous expenditure signifies the necessary expenses made out by the government of a country.

Autonomous consumption formula

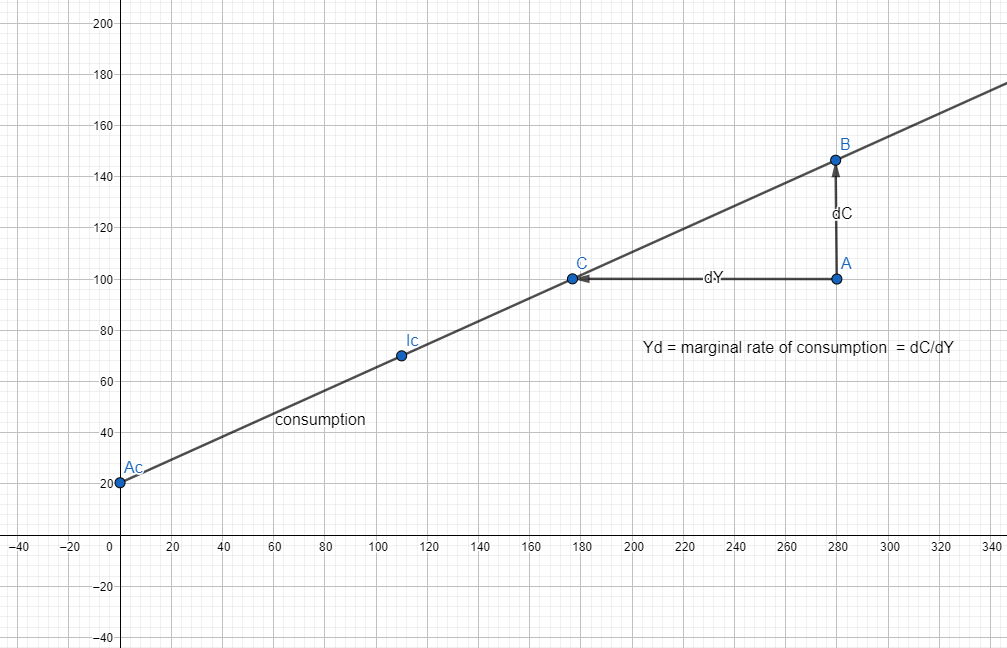

Firstly, we have defined AC to be the minimum expense a person makes irrespective of the income. Now if we consider a general case of consumption. In that case, the consumption will have two components: IC and AC.

Secondly, since we have already defined IC as the consumption which is dependent on the income, the IC will have a component that varies from person to person. Let us call this variation as cm which signifies the unit change in consumption for change in the income. This gives us the net IC as cm*Yd.

This gives us the formula for total consumption (TC) as

TC= AC+ IC

or

TC = ca+cmYd

Autonomous consumption graph

Autonomous consumption example

Some of the common examples of AC have been discussed earlier in this article. The common autonomous consumption example includes house rent, mortgages, loan EMI, groceries, clothes, etc.

However the specific examples can change from person to person. For instance, older people may require medicines for their survival while younger people may not need them.

Covid19 and Autonomous consumption

Covid19 came slowly, like a surreptitious predator. We were oblivious of ‘some virus in some Chinese province’ and kept on with our daily lives. Over the course of two months, the virus spread all over the globe. The panic came soon after. The first shock was for the aviation companies which are now struggling to keep afloat. Secondly to the tourism industry worldwide. Finally, all major economies are now at war against this virus.

The leaders of all kinds of firms now have a daunting task. There is a need to reassess the situation, restructure the supply chain, identify and fix the money leaks. However, the biggest challenge in these times is to understand the disillusioned, impoverish, and highly skeptical consumer. The business in times of recession is tough; business in the times of depression is tougher.

Managing through crisis

Firms need to be cognizant of the economic situation. This is the first time since the Great Depression that economies are expected to nosedive worldwide. We cannot predict the actual damage. In the best-case scenario, it would still be worse than the 2008 recession.

- Reduce inventory – one of the key challenges is to manage the inventories. The economic shock has sent ripples across the supply chains. Managing inventory for AC goods like foodgrains is paramount.

- Accumulate assets – firms that are not depleted of cash can take advantage of this situation. The assets are cheaper to procure in these times.

- Autonomous Consumption: consumer expenses would be primarily directed towards essential goods and services. Improve your product offering by providing necessary and budget-friendly options.

- Self-reliant offerings – firms that sell DIY kits will make money. Also, gardening, farming, and other self-reliance products will sell.

- Downsize – downsizing is the key to saving money. Firms can reduce production of non-essential goods. Alternatively, expand the portfolio into essential goods may help.

Read our Covid-19 resources by clicking here.