In the simplest sense, the risk is the possibility of something going wrong. When it comes to corporates risk analysis takes a very important role. There are many risk analysis benefits for the firm. The assessment of risk is the first step towards mitigating the ill effects of the risk.

Contents

Types of risks

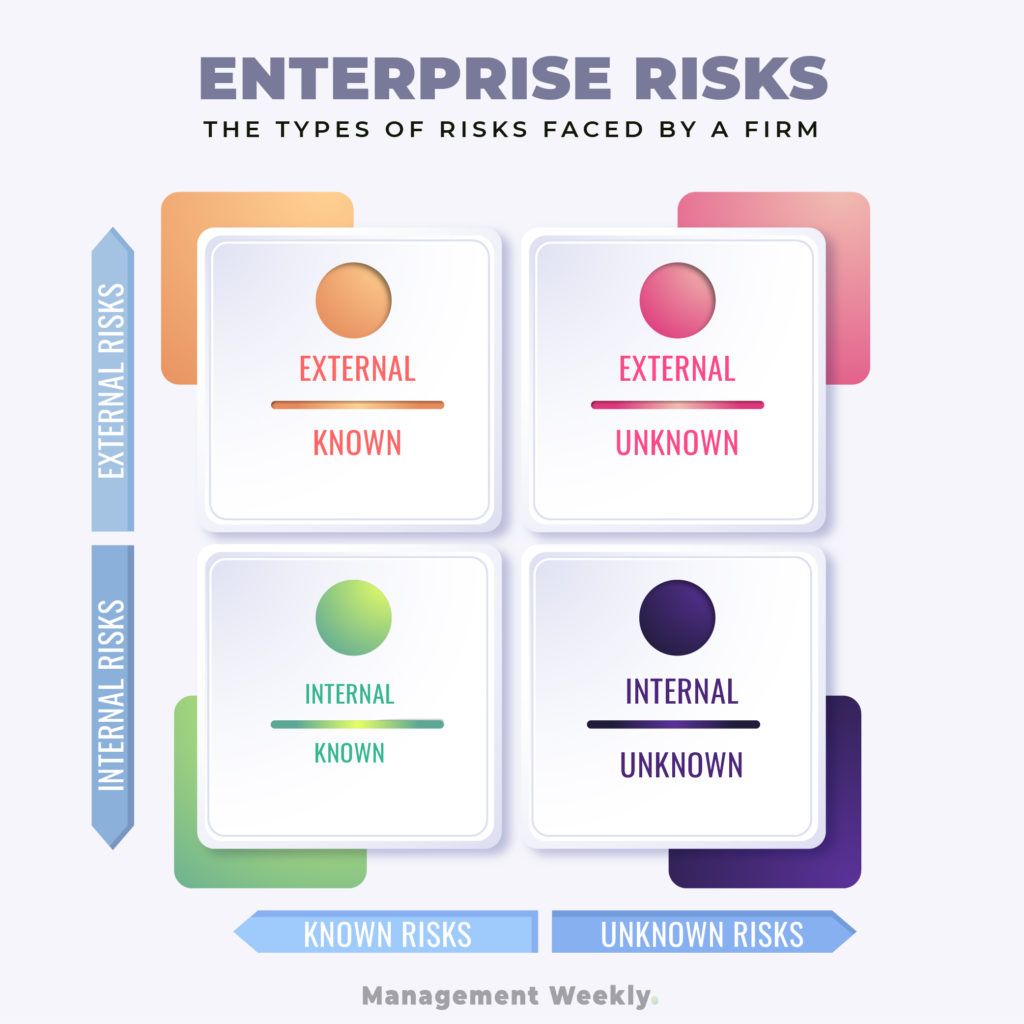

First, let us look at the types of risks that a firm can face. We can divide the risks into two bases. This will make the risk analysis for the firm easier. Firstly, based on the location of the risks. Secondly, based on whether the risk is known or unknown. Thereby, we can classify the risks into four broad categories as shown below:

Location of risks

- Internal risks

- External risks

Risk identification

- Known risks

- Unknown risks

Now, let us check out these risks in detail below.

Internal Risks

- Safety risk

Any company that is operating entails some form of safety risk. When we think of workplace safety usually we thank about manufacturing. Even companies that are in the service sector can have some form of workplace safety risks. - Fraud

Fraud can happen to any company. In fact, can be classified as both internal as well as external risk. This would depend on where the risk is coming from. The internal front risks come from the employees. - Operational risk

There is always a threat to the disruption of the firm’s operations. These disruptions could be related to the resources. Additionally, they can also come from people. - Mismanagement risks

Companies are essentially living examples of the principal-agent problem. Actions of the employees could have negative repercussions for the firm.

External Risks

There are also different kinds of external risks for the firm. Some of these are as follows.

- Market risks

Markets are highly volatile and dynamic. the preferences of customers can change rapidly. Additionally, there could be problems with the distribution network. - The risks due to business rivals

This is one of the classical risks for the firm. Competitors are always looking at ways of eating your market share. - Credit risks

The basis of all business transactions is money. it is almost impossible to run forms without financial risks. a firm must be aware of the financial risks it is taking because of the death as well as exposure to the equity markets. - Supply chain risks

Modern supply chains have embraced the Japanese concept of just in time. These kinds of supply chains are highly vulnerable. In the situations of global crisis, these chains can be disrupted. - Geopolitical risks

Risk analysis is incomplete without considering this type of risk. Policy changes can be risky for firms.

Known Risks

This type of risk is known to the firm before they occur. A firm can prepare for them and act accordingly.

It is easier to mitigate the effect of these types of risks. However, these risks should not be taken lightly. Although it is easier to manage these kinds of risks, still forms can make some mistakes.

Firstly, not realizing the extent of damage that risk can do. Secondly, not acting upon the risks. Thirdly, not acting enough on the risks. Fourthly, not acting quickly on the risks.

Unknown Risks

These are those risks that take you by surprise. Generally rest that are not detected before they occur. Also, risks that are totally new to the firm.

It is more difficult to manage this type of risk. However, that does not mean that firms cannot counter these risks. Nevertheless, risk assessment and mitigation strategy can lessen the impact of the unknown risks.

Firstly, there should be risk detection systems at all levels in the firm. Secondly, impending unknown risks should be escalated. Thirdly, immediate action must be taken on these types of risks.

What are the risk analysis benefits for the firm?

- Financial benefits

If risks are known for the potential financial losses for the firm. Therefore, any kind of risk mitigation results in financial gain. - Reputation

Investors closely follow corporate governance. They demand thorough due diligence and risk assessment. Risk analysis benefits for the firm is a better reputation. Consequently, investors reward these companies handsomely. - Competitive advantage

Risk assessment can also result in the uncovering of competitive advantage. The insights that you get from the analysis can help you provide a unique proposition to the customers. - Higher well-being for the employees

The risk analysis benefit for the form is also in the form of higher well being. Employees feel safer and more secure working for organizations that are prudent with risk management. - Engagement in calculated risks

Not all risks are bad. Risk analysis can also reveal those risks that could be highly profitable for your firm. - Higher coordination among different teams

Risk assessment not only reviews the chinks in the armor, but it also helps increase coordination. The coordination can be quite productive for the firm. - Budget control

Runaway projects can have severe implications on the budget. Interestingly, one of the common reasons for projects going out of control is risks. Therefore one of the risk analysis benefits for the firm in control of budgets. - Managing unpredicted risks is also easier.

Risk assessment not just reduces the impact of the known risks it also helps us counter unpredictable risks. The entire system of risk management helps us understand the internal structure better. The risk assessment also creates an organizational memory of managing risks. Additionally, the hierarchy of problem escalation becomes clearer. In other words, risk analysis can in fact help us fight even the unpredictable risks.

How to identify risks?

American researcher Baruch Fishchhoff published a paper based on 20 years of research on risk. Outlined some important steps that can be taken to identify risks. Risk perception can be a tricky concept as everyone has to agree on it. Although his work was on health risks, the same concept can be applied to management too.

First of all, we need to list the outcomes. then it should be a consensus about what are the expected outcomes for the firm or the project.

Secondly, we need to build a list all the variables that could impact these outcomes.

Thirdly, we also need to look into the co-relationship of these factors. This could tell us something about their interaction. Additionally, it would also reveal the level of risk and potential damage.

Finally, we need to ascertain our confidence in these factors. Certain risks are imminent while others main have a lower chance of happening.

An overview of the types of enterprise risks

A firm is exposed to different kinds of risks. Internal vs external risks. Risks that threaten a department vs risks that threaten the entire firm. Nevertheless, let’s look at some of the most common risks that a firm faces:

- Political risks

- Ecological risks

- Natural calamities

- Resource risks

- Market disruptions

- Credit risks

- Public relations risks

- Competitive risks

- Retaliatory risks

- Supply chain risks

- Asset risks

- Risks to human resources

- Risks to business subsidiaries

- Product failures or project failures

A summary of the risk analysis benefits

Proactivity is a great virtue. Especially, in case of risks. Here are some advantages of risk management:

- Identification of opportunities.

- Early identification of threats.

- Better corporate governance.

- Appropriate response mechanism.

- Minimization of loss due to the risks.

- Lower burden on the employees.

- Stability of the stock in the market for publicly traded companies.