Countries across the globe are becoming very specific about the reporting standards. This is essential in the case of accounting for carbon credits as well. The environmental aspects are an integral aspect of financial reporting now. It is no longer a question of whether firms should do it but the question is that of how should they do it.

Although the big four accounting firms have their standard practices, the onus is there on the governments to make provide a standard. However, the accounting standards are yet to provide clear guidance in this regard. Therefore, we observe a lack of parity when we compare companies that are reducing their carbon footprint.

Contents

A Quick Introduction to Carbon Credits

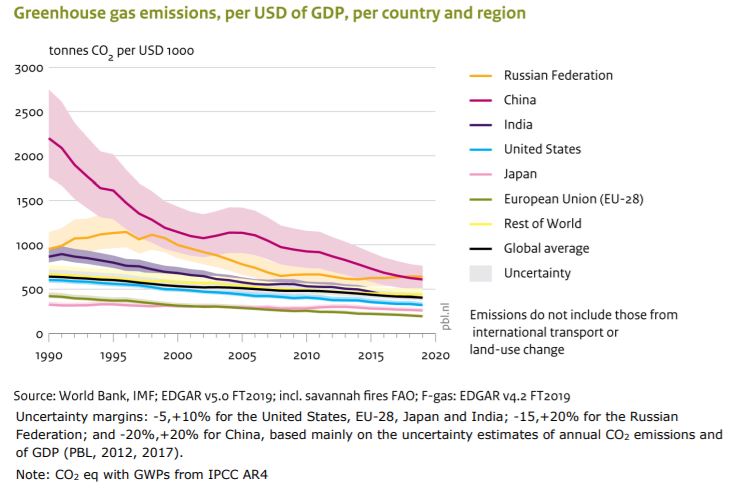

One of the dark sides of economic growth is the damage it causes to our environment. There was a growing debate about measuring this damage, which leads to the development of carbon credits. The Kyoto Protocol came into existence in 1997. It extended the scope of the United Nations’ Framework for Climate Change. The objective was to ensure that countries actively participate in reducing their Green House Gases (GHG) emissions.

Therefore, the concept of carbon credit was created. Carbon credit refers to a tradeable certificate that allows an entity to have one ton of CO2 emissions. Now, it is also important to note that when we are talking about CO2 emissions, it also includes the equivalents. For example, a manufacturing plant may produce other gases like methane which can be converted to equivalent CO2 emissions.

The Kyoto Protocol provides practical ways to reduce the overall GHG emissions of the world. One of the ways of reducing carbon emissions is by reducing the GHG emissions in a country where it is easier or cheaper. For instance, it may cost a Japanese country USD 100 million to reduce GHG emissions in its plant in Kyoto. However, it can pay USD 40 million to a manufacturing plant in Vietnam to achieve the same results. Similarly, on a country level, let’s say China produces an excess carbon in the year 20XX. They can purchase the same amount of carbon credit from a country that has less carbon emission.

⚡ NOTE ► Scopes of emissions

Companies like Facebook or Airbnb may not have factories or manufacturing plants that create greenhouse gases. These companies may not have this type of environmental impact called ‘direction emissions’ or they may have very small direct emissions. Nevertheless, they may still have indirect emissions. Therefore, they are also bound by the regulatory requirements. For instance, Microsoft extensively works on its CSR activities to ensure that they are not just compliant but also proactive in sustainability. Similarly, Amazon’s CSR reporting ensures that they assess their direct as well as indirect activities. A study on Airbnb stays in Sydney revealed that the indirect emissions would be significant for the firm. They estimate that each stay generates anywhere between 44 to 46 kg of CO2.

Greenhouse Gas Protocol posits these three scopes for emissions:

Scope 1: Direct emissions from sources owned by the company

Scope 2: Indirect emissions that result from the purchase of energy

Scope 3: Emissions as a result of the upstream or downstream activities in a company’s value chain.

It is most difficult to work on accounting for carbon credits for the scope 3 emissions.

The carbon transactions

Let us understand this concept from scratch by taking a simplified example of two firms: Cherry LLC and Pineapple LLC. These are (fictitious )large multinational corporations based in Northern New Jersey. Both provide Software as a Service (SaaS). However, they have very different approaches to energy usage.

Cherry is an older company therefore uses older servers, and draws all of its electricity from the power grid. Around 57% of the power comes from natural gas. Therefore, it indirectly contributes to significant carbon emissions. Let us say it emits 100 tons of CO2 equivalent (also called eCO2t).

On the other hand, Pineapple set up its servers recently and invested $20 million in renewable electricity plants. They end up emitting about 20 tons of CO2. Let us say that local emissions regulations require them to stay within 80 tons of CO2 equivalent for a year. In this case, Cherry will purchase 20 carbon credits from Pineapple and maintain the requirement.

Accounting Methodology

Although accounting methodology may vary from the practices of a particular geography, we have attempted to provide an overview of the standard practices:

| Asset or Expense? | Carbon certificates are usually classified as an intangible asset. They fall under the standard definition of assets which include resources owned by an enterprise that can provide future cash flows. |

|---|---|

| Measurement | One of the important aspects of accounting for Carbon credits is measuring carbon credits. There are various costs that can contribute to the cost of carbon credits. Most notably, the cost of research and development, cost of development of new technology for emission reduction, and, other costs associated with execution and monitoring of green initiatives in a firm. |

| How are the carbon credits valued? | The United Nations Framework Convention on Climate Change or UNFCC looks after the certification of the carbon credits. The Clean Development Mechanism or CDM allows companies to account for the emission reduction activities. UNFCC levies a feed of 2% from the companies. They issue a Certified Emission Reduction or CER credit for every ton of CO2 emission reduction. |

| Cost of certification | The commonly accepted practice is to inventorize the cost of certification. UNFCC maintains a list of least developed countries. There is zero percent levy on these. What this means is that the certificates are issued free of charge to the entities from these counries. However, most countries are charged. The charges can be either percentage of certificates issued or a fixed monetary charge. For example, if first method is used then if you apply for 100 certificates, the processing charge will be deducted from these 100 and you will get 98 certificates issued to you. On the other hand, if fixed charge is used, then you will receive all 100 certificates but you have to pay for the certificate issued to you. |

| Income statement | The net realized value after the sale of CER can be entered into the income statement. You may want to refer to the accounting guidelines of your particular country for reference. |

Carbon Credits accounting at PwC

PricewaterhouseCoopers is a leading accounting and consulting firm. They are among the big four accounting firms. Therefore, it is pertinent to understand their functioning and prerogatives in the context of carbon credit accounting. PwC sustainability accounting consists of the following aspects:

- Understanding the client requirements

- Client assessment through an internal audit

- Preparation of the reports in accordance with the local regulations

- Life cycle assessment of the products, processes, and services

- Consulting in the improvement of sustainability practices

Summary steps of CER accounting from PwC:

- Define the scope of business operations

- Establish the organizational boundaries

- Categorize scope 1, 2, and 3 emissions

- The reporting process is developed

- Data analysis and preparation of reports

- Assessment of energy and emissions

- Report preparation

Accounting systems for IFRS

IFRIC 3 and its withdrawal

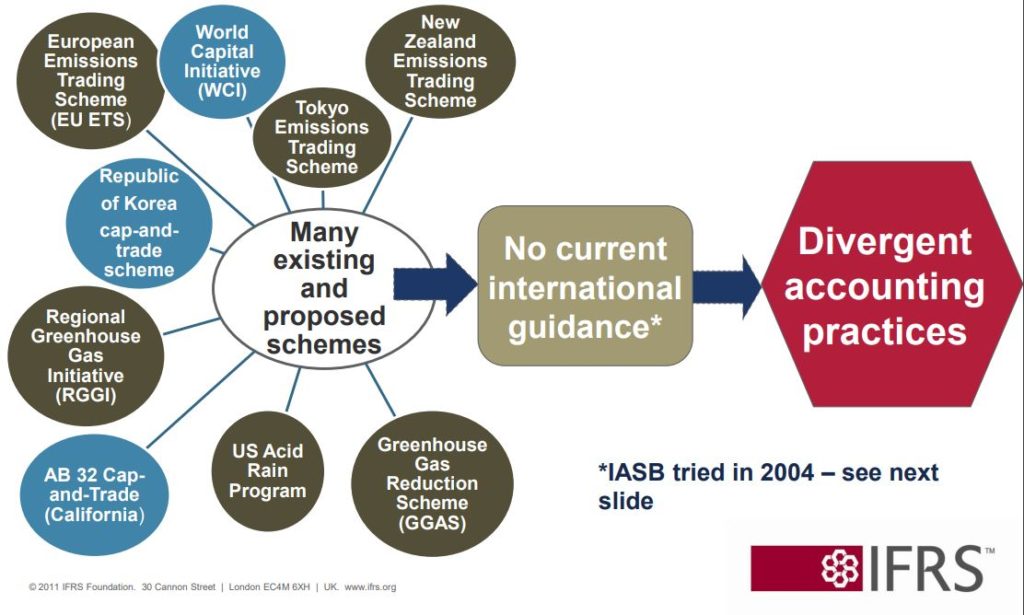

The International Financial Reporting Standards (IFRS) are global accounting standards provided by the International Accounting Standards Board or IASB. IASB is non-profit organization that develops reporting standards that are standardized across the world. This provides an easy, understandable and enforceable mechanism. Way back in 2004, they intended to offer a standard that could standardize the carbon credit reporting. The figure below shows their objective for introduction of the IFRIC 3 which encompassed a vast array of schemes as shown in image below.

Current state of sustainability at IFRS

However, they met with resistance and criticism and they had to withdraw IFRIC 3 in 2005. You may read about IFRIC 3 and subsequent standards here. However, they continue to look into the carbon and emission reporting systems. IFRS has proposed to establish a separate board for sustainability to look into these matters. Inclined readers may wish to download and read the consultation paper on sustainability reporting from IFRS from this link.

Guidance note on Carbon credits from ICAI

The Institute of Chartered Accountants of India, has added a section on accounting for Carbon Credits. It is reflected in the final year syllabus of the program. This is a welcome change as the future accountants are expected to be abreast of environmental accounting. This will also prepare them for specialization into reporting and governance requirements.

ICAI has an accounting standards board. They have developed the standard for carbon accounting (31-GN-CER). You may view the pdf of the guidance note via the ICAI website. It is based on the Self-generated Certified Emissions Reductions or CER. This saleable certificate is nothing but a legally binding contract note for carbon credits in the same unit we discussed earlier (tCO2e or tons of CO2 equivalent). These come under the Indian Accounting Standards IAS 26.

The GN 31 specifies the following (pg 450):

- The investments in technology that leads to emission reduction is reported as tangible assets under AS 10.

- However, expenditure on R&D is accounted as intangible assets and comes under AS 26.